The financial services industry is experiencing a fundamental transformation. AI and automation aren’t just buzzwords anymore—they’re reshaping how businesses and individuals make critical financial decisions. As a web development company working with fintech clients, we’ve witnessed this shift firsthand, and the implications are profound for both financial institutions and the technology partners who build their digital infrastructure.

The Evolution of Financial Decision-Making

Remember when financial decisions relied heavily on gut instinct, historical precedent, and weeks of manual analysis? Those days are rapidly becoming a memory. Today’s financial landscape demands speed, precision, and the ability to process massive datasets in real-time. This is where AI and automation step in, not to replace human judgment, but to augment it with capabilities that were simply impossible a decade ago.

The shift is visible everywhere. From loan approvals that once took weeks now happening in minutes, to investment portfolios that rebalance themselves based on market conditions, to fraud detection systems that identify suspicious transactions before they’re completed—AI is fundamentally changing the game.

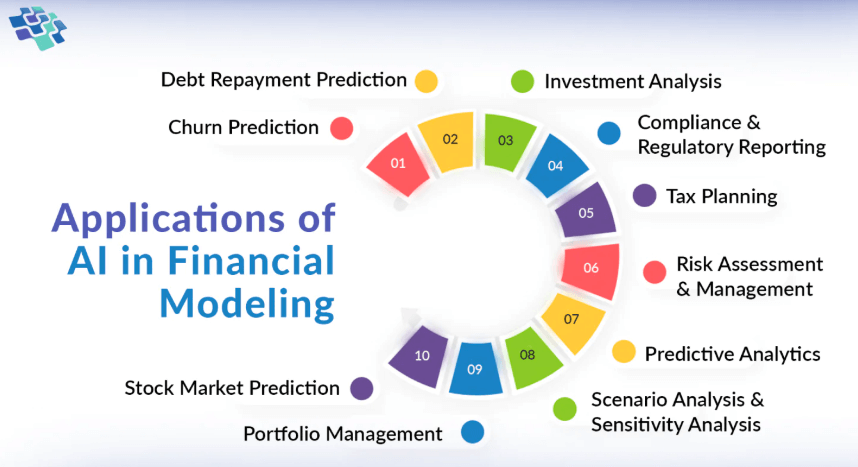

Key Areas Where AI Is Making an Impact

Predictive Analytics and Risk Assessment

One of the most significant applications we’re seeing is in predictive analytics. Machine learning models can now analyze thousands of variables simultaneously to assess credit risk, predict market movements, and identify potential defaults before they happen. These systems learn from historical data patterns, but they also adapt to new information in real-time.

For web developers, this translates into several critical implementation areas:

- Real-time data processing pipelines that can ingest and analyze market data, transaction histories, and economic indicators simultaneously

- Advanced API architectures capable of handling high-frequency requests from multiple AI models without latency

- Interactive dashboards that visualize complex risk metrics in intuitive ways for financial analysts

- Integration layers connecting AI models with legacy banking systems and core financial platforms

- Alerting mechanisms that notify decision-makers when AI identifies significant risk factors

- Historical data warehouses optimized for both training machine learning models and generating reports

Let’s solve your ngo problem together

Automated Trading and Portfolio Management

Algorithmic trading has evolved from simple rule-based systems to sophisticated AI agents that can execute complex strategies across multiple markets simultaneously. Robo-advisors are democratizing wealth management, offering personalized portfolio recommendations that were once available only to high-net-worth individuals.

The development implications here are substantial:

- Infrastructure scalability: Systems need to handle microsecond-level transactions without latency issues

- Security protocols: Automated systems managing real money require military-grade security implementations

- Compliance frameworks: Every automated decision must be logged, auditable, and compliant with financial regulations

- User experience design: Clients need to trust AI recommendations, which means transparent interfaces that explain the “why” behind decisions

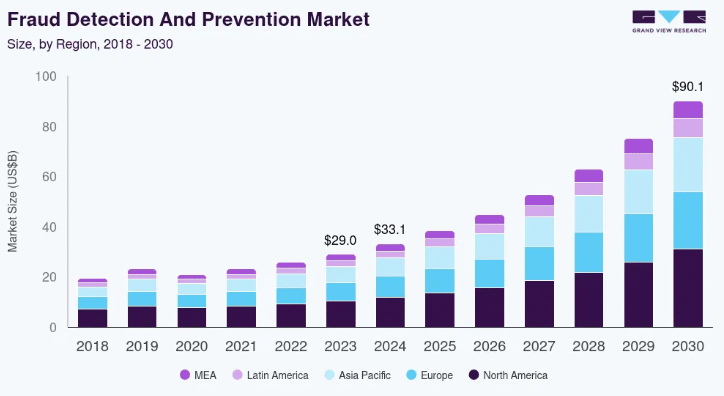

Fraud Detection and Prevention

AI-powered fraud detection Feedzai represents one of the clearest wins for automation in finance. Traditional rule-based systems could flag obvious anomalies, but modern machine learning models detect subtle patterns that humans would never catch.

These systems analyze multiple data points in real-time:

- Behavioral biometrics: Tracking how users type, swipe, and navigate through applications

- Transaction patterns: Identifying unusual spending behaviors based on historical data

- Geolocation analysis: Flagging transactions from unexpected or impossible locations

- Device fingerprinting: Recognizing trusted devices and flagging new or suspicious ones

- Network analysis: Detecting connections between seemingly unrelated fraudulent accounts

- Time-based patterns: Identifying suspicious timing in transaction sequences

From a development perspective, implementing these systems requires sophisticated data pipelines, real-time processing capabilities, and carefully designed user flows that can halt suspicious transactions without creating friction for legitimate users. The balance between security and user experience is delicate, and it’s where thoughtful web development makes all the difference.

The Technical Architecture Behind Financial AI

Building applications that leverage AI for financial decision-making requires a robust technical foundation. Here’s what we’re implementing for our fintech clients:

Data Infrastructure: Building data warehouses that ingest from multiple sources, clean and normalize information, and support both ML training and real-time inference using Apache Kafka, PostgreSQL, and cloud-based data lakes

API-First Architecture: Creating RESTful and GraphQL APIs that deliver sub-second latency for AI decisions, with robust error handling, rate limiting, and authentication protocols

Microservices and Containerization: Implementing independent components for risk assessment, fraud detection, and portfolio optimization using Docker and Kubernetes for scalable deployment

Challenges and Considerations

Despite the tremendous potential, implementing AI in financial decision-making comes with significant challenges that we navigate with our clients:Regulatory Compliance

Financial services are heavily regulated, and AI adds complexity. Key considerations include:- Model explainability: Implementing frameworks that can explain AI decisions to regulators and customers

- Audit trails: Maintaining comprehensive logs of every AI-driven decision

- Bias detection: Regular testing to ensure models don’t inadvertently discriminate

- Regulatory reporting: Building systems that generate compliance reports automatically

- Version control: Tracking model iterations and their performance for regulatory review

Data Privacy and Security

Financial data is sensitive, and AI systems often require extensive data access to function effectively:- End-to-end encryption: Protecting data both in transit and at rest

- Access controls: Implementing role-based permissions and multi-factor authentication

- Data anonymization: Masking sensitive information while maintaining model performance

- Secure API gateways: Protecting AI endpoints from unauthorized access

- Regular security audits: Continuous vulnerability assessments and penetration testing

The Human Element

Perhaps the most underestimated challenge is helping financial professionals trust and effectively use AI tools:- Intuitive interfaces: Designing UX that makes complex AI outputs understandable

- Contextual explanations: Providing the reasoning behind AI recommendations

- Human override capabilities: Allowing professionals to intervene when necessary

- Training and onboarding: Building in-app guidance for new AI features

- Feedback loops: Creating mechanisms for users to improve model performance

What This Means for Financial Institutions

For banks, investment firms, and fintech startups, the message is clear: AI and automation aren’t optional anymore. They’re competitive necessities. Institutions that successfully integrate these technologies gain significant advantages in speed, accuracy, and cost efficiency.

But successful integration requires the right technical partner. As web developers, our role extends beyond coding—we’re translating complex AI capabilities into usable, reliable, and compliant financial applications. We’re building the digital infrastructure that allows financial professionals to make better decisions faster.

Conclusion : The trajectory is clear

AI and automation will continue to expand their role in financial decision-making. We’re already seeing emerging technologies like natural language processing for analyzing earnings calls and news sentiment, computer vision for processing financial documents, and reinforcement learning for optimizing trading strategies.

The transformation is already underway. The question isn’t whether AI will reshape financial decision-making, but how quickly your organization can adapt to this new reality.

Bigpage can help you to grow your business digitally through well-defined website content, building a dynamic website for you to enhance your online presence and get more clients through various Facebook, Instagram Ads

Agrodut is a managing director and seasoned digital marketing specialist passionate about SEO. With 15 years of experience, he has helped numerous businesses elevate their online presence and achieve higher search engine rankings. A results-driven professional, Agrodut Mondal stays updated with the latest SEO trends and best practices to ensure cutting-edge strategies. When not optimising websites, he enjoys exploring new technology and sharing insights through writing and speaking engagements. Connect with Agrodut for expert guidance on unlocking your website’s full potential in the digital.